As of April 2025, some big changes were made to the way that VED tax is charged in the UK. These have had a significant effect on the amount of road tax owners of electric cars will pay, and also buyers of most brand new cars, but owners of most types of car will be affected in some way or another.

In this guide, we explain precisely what these changes are and how they will affect you, as well as exactly what VED road tax is, why it exists, how it works, and how it has changed over the years. Which it has. A lot.

UK Road Tax Explained

- What is VED?

- VED Rates from April 2025

- VED Rates for Cars Registered After April 2017

- Expensive Car Supplement for Cars Costing Over £40,000

- VED Rates for Cars registered between March 2001 and April 2017

- VED Rates for Cars Registered Before March 2001

- How Do I Buy VED?

- Historic Vehicle Tax Exemption

- What Does SORN Mean?

- Whatever Happened to the Tax Disc?

What is VED?

VED stands for Vehicle Excise Duty, and is the term used to describe the tax you must pay the treasury if you own a car in the UK that is driven – or even parked – on a public road. VED is often referred to as road tax, car tax, or the road fund licence, and the amount you’ll have to pay will depend on the car you drive.

The way VED is calculated and the tax rate car owners must pay is based on a number of factors, including the age of your car. These are worth understanding, especially if you're about to buy a used car, because the tax costs could vary, even between two identical cars, depending on the precise date they were registered.

VED Rates from April 2025

On April 1st 2025, at the beginning of the 2024/2025 tax year, significant changes were applied to the tax system. Let’s first consider the scope of the changes for cars with combustion engines.

The flat rate for petrol and diesel cars rose by £5 to £195 per year, and the small discount (£10) for AFVs (alternative fuel vehicles) was scrapped, making them liable for the same £195 flat rate (assuming they were built after 2017. AFVs built before 2017 qualify for a previous set of rules, outlined later in this guide). The expensive car supplement for cars costing over £40,000 (again, more on this in a second) was also raised, this time from £410 to £425.

However, bigger changes were made to the amount of VED you'll need to pay in the first year of a vehicle's life. Like the previous VED tax system (outlined in the next section), these are based on the vehicle's CO2 emissions, but have become more expensive across the board as of 2025. Broadly speaking, buyers of the very cleanest plug-in hybrid cars will pay around £100 more than before in first-year tax rates, while owners of low-emissions vehicles with an output of more than 76g/km, plus all other vehicles with heavier emissions, will likely see their first-year VED outlay double. We say ‘likely’, because buyers of diesel cars that are not RDE2 compliant will pay even more because they’re still subject to the one-group price hikes first introduced in 2018, and with the elevated costs across the board, this can amount to quite a lot of cash in some cases. However, there are so few non-RDE2-compliant diesels left on sale these days that this will affect so few drivers as to be largely irrelevant.

The greatest changes of all, though, will be felt by buyers of EVs, and not in a good way, because most VED exemptions for EVs have been abolished. In terms of first-year rates, the news is far from catastrophic. You’ll only pay a nominal sum of £10 (a figure locked in until the 2029-2030 tax year, and that’s a minimum of £100 lower than even the cleanest non-EVs), and that shows that there’s still an incentive for buyers to choose electric cars.

However, that’s about the only incentive you’ll get, because from then on, you’ll be liable for the same flat rate of VED tax (£195 per year) as drivers of all other types of car. No discount, no nothing.And before 2025, EVS were exempt from a yearly VED fee.

Perhaps even bigger news, though, is the fact that exemption from the luxury car surcharge for EVs has also been scrapped, and the elevated prices of premium EVs relative to posher petrol and diesel cars mean that a lot of them will be affected. The one small bit of good news, though, is that this will only apply to EVs registered from April 1st 2025 onwards, and not backdated to include £40,000-plus EVs registered in the last six years.

Whatever type of car you’re planning to buy, the tables immediately below will show what the 2025 tax rule changes will mean for you in terms of VED costs.

| CO₂ Emissions (g/km) | 2025-2026 First Year Rate (Petrol, RDE2 Diesel, AFVs, EV) | 2025 First Year Rate (Non-RDE2-Compliant Diesels) |

|---|---|---|

| 0g/km | £10 | - |

| 1–50g/km | £110 | £130 |

| 51–75g/km | £130 | £270 |

| 76–90g/km | £270 | £350 |

| 91–100g/km | £350 | £390 |

| 101–110g/km | £390 | £440 |

| 111–130g/km | £440 | £540 |

| 131–150g/km | £540 | £1,360 |

| 151–170g/km | £1,360 | £2,190 |

| 171–190g/km | £2,190 | £3,300 |

| 191–225g/km | £3,300 | £4,680 |

| 226–255g/km | £4,680 | £5,490 |

| 255+g/km | £5,490 | £5,490 |

Second-year onwards flat rate (all fuel types): £195

Luxury car supplement for cars over £40,000 (all fuel types): £425

In other news, EVs registered between March 2001 and March 2017 will now pay £20 per year in VED road tax, and electric vans will now be charged £335 per year in VED road tax, the same as their petrol and diesel equivalents.

VED Rates for Cars Registered between 1 April 2017 and 1 April 2025

The exchequer introduced new tax changes in 2017, which broadly form the system that is still used today. And so, any car registered after 1 April 2017, including new vehicles, falls under a scheme of VED bands where there was a one-off first-year rate linked to CO2 emissions.

Then, from the second year onwards, a car’s annual VED rate is no longer based on CO2 emissions, but fuel type. So, regardless of whether you owned a petrol car or diesel car, you’ll pay the same flat rate of tax. When introduced, this flat rate stood at £180 per year. If you owned an alternative fuel vehicle (or AFV - that’s hybrids, including 48-volt mild hybrids, Bioethanol cars, Liquid Petroleum Gas - or LPG - cars), you got a discount of £10 per year, leaving you with £170 to pay. If you had a pure electric car with zero emissions, you remained exempt from paying VED, although you did still need to apply for it on an annual basis.

To further complicate matters, in April 2018 a new rule was introduced that bumped up by one band any diesel car not conforming to Real Driving Emissions 2 (RDE2) standards, although even at that time, the majority of new diesel cars did. Are you keeping up?

Expensive Car Supplement for Cars Costing Over £40,000

As if things weren't already complicated enough, along came the Expensive Car Supplement. This stated that any car registered from April 2017 onwards with a list price of more than £40,000 when brand new (that included any optional extras you added at the time of purchase) was also liable for an additional expensive car supplement (sometimes also known as the ‘luxury car surcharge’) on top of the flat rate of VED, for a five-year period between years two and six of the car’s life. At the time these rules were introduced, this surcharge stood at £390 per year, leaving you with a total of £570 per year to pay during that period, or £560 for AFVs. At the end of that period, you reverted back to paying just the flat rate.

Crucially, all pure electric cars - which were ordinarily a lot more expensive to buy than their petrol and diesel counterparts, with many busting the £40,000 threshold - were exempt from the luxury car surcharge, and so owners still paid nothing for VED. Unfortunately for EV owners, the 2025 changes put paid to that.

VED Rates for Cars Registered Between March 2001 and April 2017

Under the previous-previous system of VED - which still applies to a lot of used cars - the rate you'll pay is determined by its carbon dioxide (CO2) emissions. The more polluting the car, the more you pay.

To find out car costs when it comes to tax, you need to know which car tax band a particular vehicle falls into, ranging from A to M. This is listed on the car’s V5C. If you need to ascertain how much VED you’ll pay for a car you don’t yet own, use the search function on the Department for Transport’s VCA website. The current rates, updated for April 2025, are outlined in this table:

| VED Band | CO₂ Emissions (g/km) | Petrol & Diesel Standard Rate (per year) |

|---|---|---|

| A | 0–100 | £20 |

| B | 101–110 | £20 |

| C | 111–120 | £35 |

| D | 121–130 | £165 |

| E | 131–140 | £195 |

| F | 141–150 | £215 |

| G | 151–165 | £265 |

| H | 166–175 | £315 |

| I | 176–185 | £345 |

| J | 186–200 | £395 |

| K* | 201–225 | £430 |

| L | 226–255 | £735 |

| M | Over 255 | £760 |

Note:

*If your car was registered before 23 March 2006, this is the most you’ll be required to pay in VED.

VED Rates for Cars Registered Before March 2001

If you own a car registered for the first time as a new car prior to March 2001, calculating how much VED to pay is even easier, as the tax system is based purely on engine size and there are only two standard rates.

If the engine’s capacity is less than 1,549cc, you’ll pay £220 per year.

If the engine's capacity is more than 1,549cc you’ll pay £360 per year.

If you’re not sure of your car’s engine capacity, it is listed on the V5C registration certificate, also known as the logbook. For more details visit our guide to finding out what engine is in your car.

How Do I Buy VED?

You can apply for VED online, by phone (0300 123 4321), or in person at a Post Office. Payment can be made up front for 12 months, 6 months, or monthly via direct debit, although be aware that the latter two options incur a 5% surcharge per year.

VED cannot be transferred when you buy or sell a car. If there is more than a month of VED left to run on a car you’re selling, you will automatically be issued a refund (by cheque) from the Driver & Vehicle Licensing Agency (DVLA), triggered when the new owner registers the car.

Historic Vehicle Tax Exemption

If you own a car built prior to 1 January 1979, you can apply for exemption from paying VED. To do this, complete the relevant section of the car’s V5C registration form (this form is like your car’s birth certificate, so hopefully you’ve filed it somewhere safe) and take it, an MoT certificate, and a V10 tax application form to a Post Office. A member of the staff will be able to initiate the process of reclassifying your car as historic.

Given a 40-year rolling exemption, the threshold for what qualifies as a historic vehicle changes every year, so in 2026 it will move to 1986, in 2027 to 1987, and so on.

What Does SORN Mean?

SORN stands for Statutory Off-Road Notification and means your car is not subject to tax because it is not used on the road. It only applies if you own a car that is not driven or parked on the road (if, for example, it is kept on private land). You must notify the DVLA that the vehicle isn’t used by completing a Statutory Off-Road Notification (SORN), which can be done online, by phone (using the number listed earlier in this article), or by filling out the relevant form (V890) at a post office.

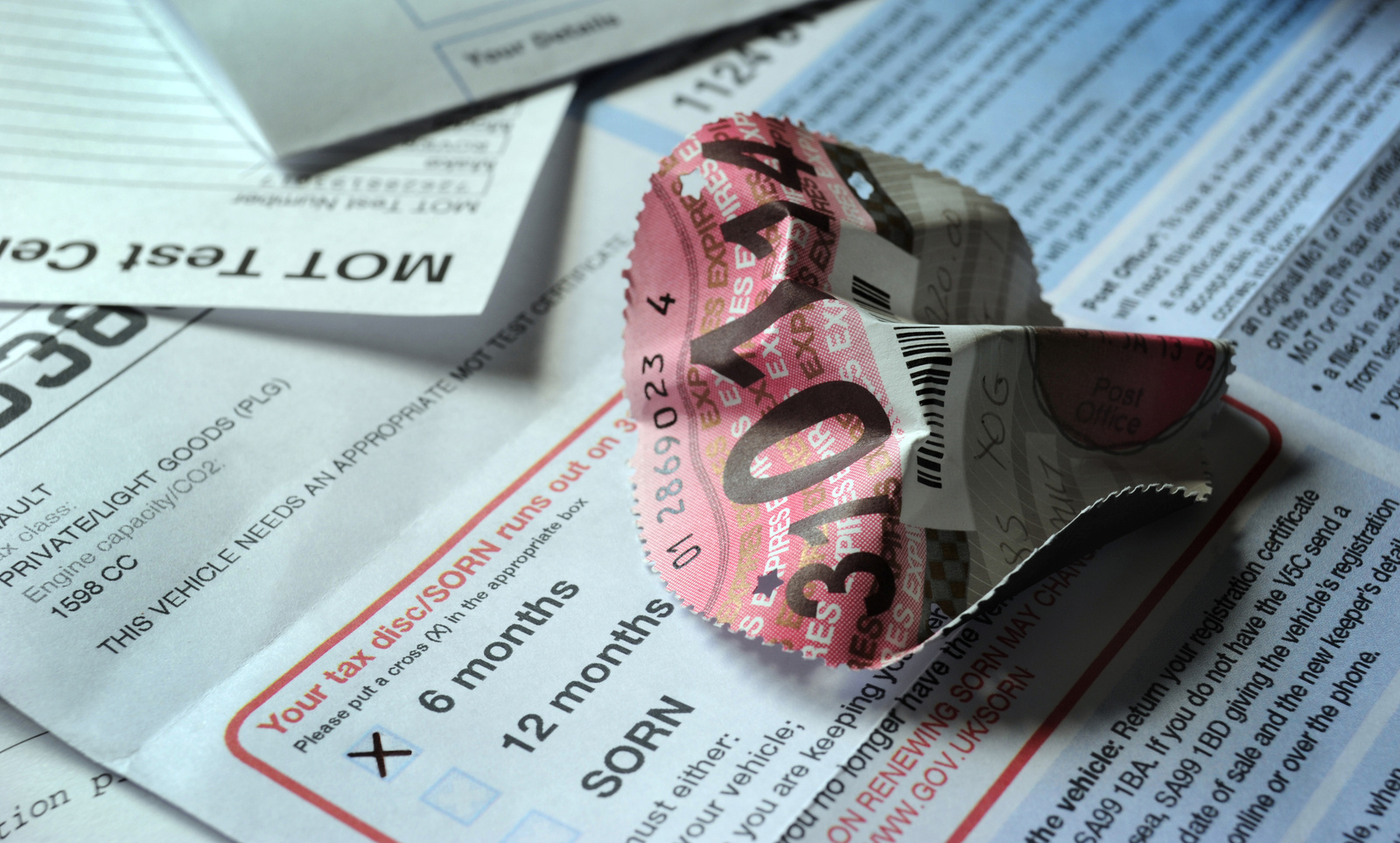

Whatever Happened to the Tax Disc?

You used to be able to tell if a car was taxed simply by looking at the little round disc displayed in its windscreen. Introduced in 1921, the tax-disc system remained in place until 2014, at which time the DVLA and the police deemed that their increasing reliance on an electronic register of car details had made these familiar paper discs superfluous.